このページに知りたい情報がない場合は

世田谷区トップページ > 福祉・健康 > 生活支援 > 支援金・給付金 > 【申請受付終了】令和6年度世田谷区住民税非課税世帯への物価高騰対策給付金及びこども加算について > 【The application period has already ended】Setagaya City Fiscal Year 2024 Price Hike Countermeasure Benefit for Households Exempt from Resident Tax and Additional Child Allowance

ここから本文です。

最終更新日 2025年7月1日

ページID 23620

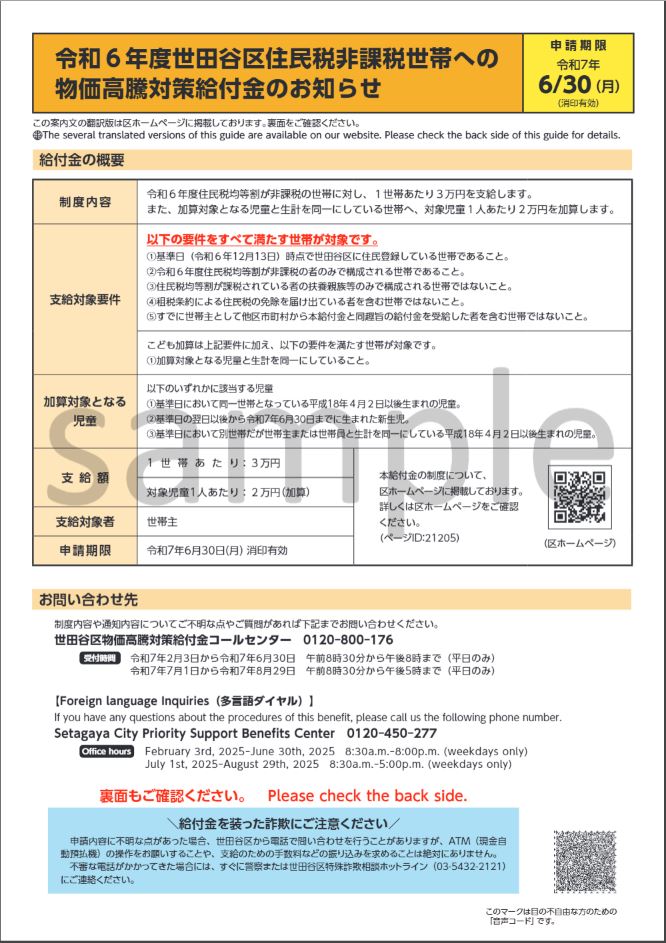

【The application period has already ended】Setagaya City Fiscal Year 2024 Price Hike Countermeasure Benefit for Households Exempt from Resident Tax and Additional Child Allowance

The application period for the Setagaya City Fiscal Year 2024 Price Hike Countermeasure Benefit for Households Exempt from Resident Tax and Additional Child Allowance ended as of June 30, 2025 (Monday) (Same day postmark is valid).

The following page provides information in Chinese,Korean,and Vietnamese.

The application period ended on June 30, 2025

The application period for the Setagaya City Fiscal Year 2024 Price Hike Countermeasure Benefit for Households Exempt from Resident Tax and Additional Child Allowance ended as of June 30, 2025 (Monday) (Same day postmark is valid).

Setagaya City Priority Support Benefits Center

If you have any questions about the benefits, please contact the call center. Personnel at this phone number can be consulted in foreign languages.

Phone number: 0120-450-277

Hours: 8:30 a.m. to 5:00 p.m. (weekdays only)

(Note) Closed on Saturdays, Sundays, and national holidays.

Notice

- On March 13, a notice of provision (postcard) was sent out.

- On April 22, the confirmation letter and application form (envelope) were sent out.

Outline of this initiative

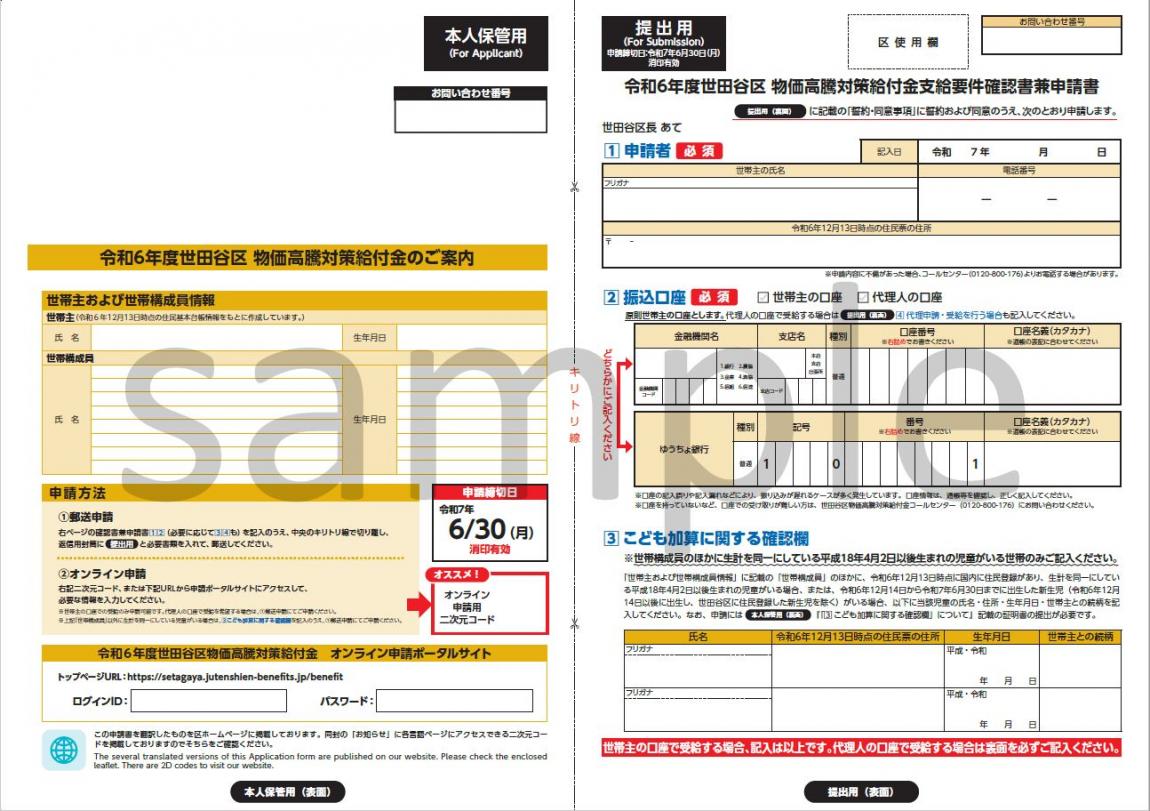

Based on the economic stimulus measures approved by the government in its supplementary budget on December 17, 2024, 30,000 yen per household will be provided to households exempt from residence tax for fiscal year 2024.

In addition, households eligible for the additional child allowance will receive another 20,000 yen per child.

Requirements for eligible households (fundamental)

Households whose residents are registered in Setagaya City as of December 13, 2024, (base date) and all members of the household are exempt from residence tax for the fiscal year 2024.

However, if any of the following applies, you are not eligible to receive the benefit.

- Households consisting solely of dependents of persons who are subject to the per capita residence tax.

- Households with a person who has reported the exemption of residence tax under a tax treaty.

- Households that include a person who has already received a benefit with the same purpose as this benefit as the head of household from another municipality.

Requirements for Households Eligible for Payment (additional child allowance)

Households that have one of the following children are eligible to apply for the benefits.

- A child born on or after April 2, 2006, whose living arrangements are the same as those of the head of household or household members as of the reference date.

- Newborn children born on or after the day following the base date and before June 30, 2025.

- A child born on or after April 2, 2006, who is living in a separate household as of the reference date but shares the same livelihood with the head of the household or a member of the household.

(Note) Children living abroad who are not registered as residents of Setagaya City as of the reference date are not eligible to receive the benefit.

Grantees (Beneficiaries)

Head of household.

Benefit amount

30,000 yen per household.

For households eligible for the additional child allowance, 20,000 yen will be added per eligible child.

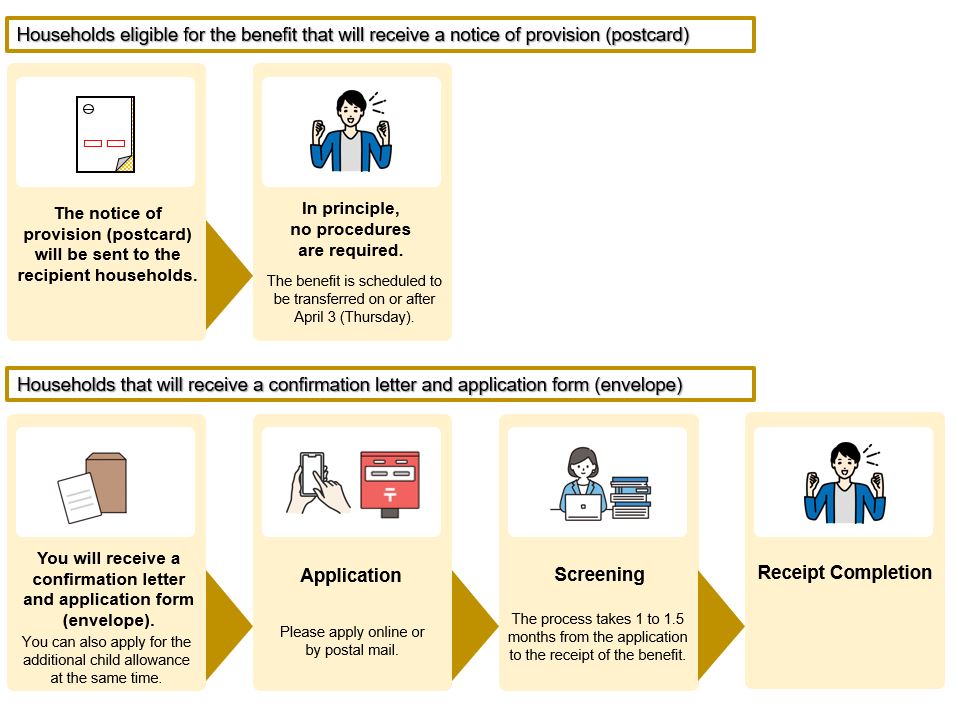

Procedures

The head of the household who is considered eligible for the benefit will receive either of the following.

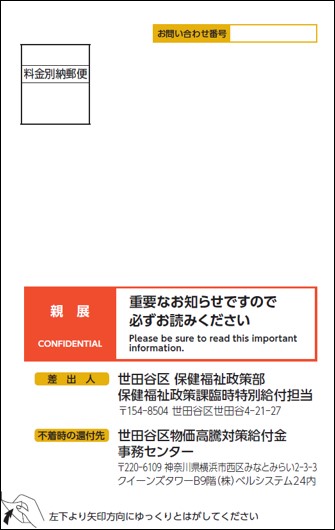

- Notice of Setagaya City Fiscal Year 2024 Price Hike Countermeasure Benefit Provision (postcard).

- Setagaya City Fiscal Year 2024 Price Hike Countermeasures Benefit confirmation letter and application form (envelope).

(Note) The Notice of Provision and Confirmation Letter and Application Form will be sent to the address where the Setagaya City can confirm your resident registration (including an address where you moved out) at the time the various documents are prepared.

1. Households that receive notice of provision (postcard)

| Sending date | Provision date |

Application deadline |

|---|---|---|

|

Shipped on March 13 (Thursday). |

Scheduled to be transferred on April 3 (Thursday). |

In principle, no procedures are required. The benefit allowance will be transferred to the account from which you received benefits in the past. (Note) Please contact the call center by 8:00 p. m. on March 26 (Wednesday) if you wish to change your account or withdraw from the program, or if you do not meet the eligibility requirements. |

Households to be sent

Households exempt from residence tax for fiscal year 2024 that have received either of the following benefits in the past shall receive the notice.

- Setagaya City Price Hike Special Assistance Benefit in fiscal year 2023.

- Setagaya City Price Hike Special Assistance Benefit in fiscal year 2024.

(Note) Households whose household composition or tax status has changed and households whose proxy received the benefit are excluded.

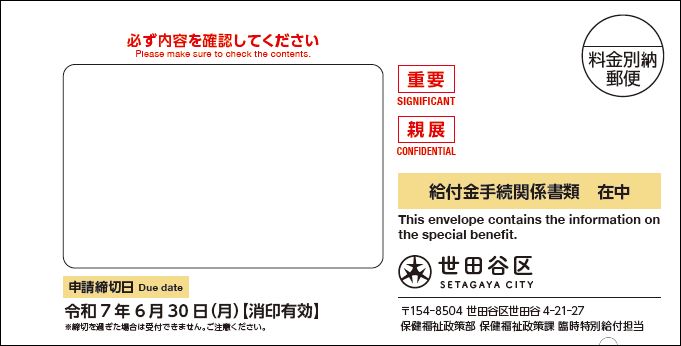

2. Households that receive a confirmation letter and application form (envelope)

| Sending date | Provision date |

Application deadline |

|---|---|---|

|

Shipped on April 22 (Tuesday). |

Scheduled to be transferred sequentially on or after May 12 (Monday) |

Effective in ones postmarked by June 30 (Monday) |

Households to be sent

Households that are not eligible for the Notice of Payment but have been confirmed to meet the eligibility requirements shall receive the application form.

How to apply

Apply online or by mail.

Application Deadline

1.Online Application

June 30 (Monday), 2025

2.Application by postal mail

Postmarked by June 30 (Monday), 2025

3. Households that need to make another request

The following households, even if they meet the eligibility requirements, will not receive the necessary documents for the procedure from Setagaya City, so another procedure must be followed. Please contact the call center by the deadline.

- Households in which all members of the household were exempted from residence tax for fiscal year 2024 because of an amended tax return after the base date.

- Households that were supported by a taxable spouse as of January 1, 2024, but divorced before the base date and are now living in a separate household.

- Households where spouses are divorced and living separately under divorce proceedings as of the base date.

- Households that include a person whose resident registration as of January 1, 2024, is in Setagaya City, but who has taxable rights are in a municipality other than Setagaya City, such as a person who files a tax return at his/her place of work.

- Households whose head of household has moved abroad since the day after the base date.

- Households wherein the certificate of residence for a person has been erased in accordance with Article 8 of the Basic Resident Registration Act prior to the reference date and who were living in Setagaya City as of the reference date but are not registered in any municipality, and whose certificate of residence was created in Setagaya City on or after the day following the reference date.

- Households other than the above that meet the eligibility requirements but have not received a confirmation letter and application form.

Deadline: June 30 (Monday), by 8:00 p. m.

Confirmation letter and application form

(Note) This confirmation letter and application form cannot be printed out for use.

Information

Information for the online application

添付ファイル

お問い合わせ先

Setagaya City Priority Support Benefits Center

Phone number:0120-450-277

Hours:8:30 a.m. to 5:00 p.m.(weekdays only)

(Note)Closed on Saturdays,Sundays,and national holidays.

(PDF:143KB)

(PDF:143KB) (PDF:970KB)

(PDF:970KB) (PDF:777KB)

(PDF:777KB)